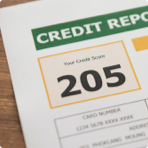

Poor credit can impact the likelihood of lenders willing to provide you with a car finance loan.

You may be scared of rejection as a result of your poor credit history, or through not having a credit history that proves you’re a responsible borrower. Hippo doesn’t believe car ownership should feel like a hopeful aspiration, so we take a different approach.

The Hippo commitment:

Everyone should have the opportunity to finance a car regardless of your circumstances – so we provide a product and service that allow you to:

- Ditch the stigma of bad credit lending by working with responsible, specialist lenders.

- Invest in your future by purchasing a vehicle that improves your lifestyle.

- Improve your financial credibility by paying fixed monthly payments that suit your budget.

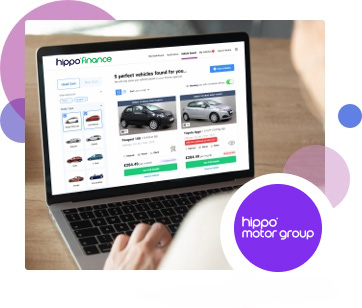

Browse 1000s of used vehicles

We stock a massive range of used cars of various styles and body types, including the world’s leading brands such as BMW and Ford.

We prepare each car in our state-of-the-art service and repair centre. Our rigorous checks ensure your vehicle is in peak condition, so you’ll feel assured as soon as you get behind the wheel. Once you’ve found your perfect car, you can collect it, or we can deliver it to any destination in the UK. All our bad credit car finance deals come with no hidden costs. What you see is what you pay – avoid the worry and stress of financing your car, and enjoy the pleasure of driving it.

How to get car finance with bad credit

Step 1Check if you'll be accepted - with no impact on your credit score!*Simply fill in our quick and easy form and we'll let you know within minutes if you'll be accepted.

Step 1Check if you'll be accepted - with no impact on your credit score!*Simply fill in our quick and easy form and we'll let you know within minutes if you'll be accepted.- Step 2Use the My Hippo app to find your carOnce you've been accepted for finance, your dedicated account manager will give you exclusive access to our portal, where you can browse 1000’s of vehicles and reserve your dream car

Step 3Drive away in your dream car!Collect your car within 48 hours from one of our showrooms or arrange nationwide delivery to your door!

Step 3Drive away in your dream car!Collect your car within 48 hours from one of our showrooms or arrange nationwide delivery to your door!

Rates from 12.9% APR. Representative APR 18.9%. We are a credit broker, not a lender.

*a hard search will be performed if you decide to proceed

Bad credit car finance for everyone

Check Your Credit Score

Car finance packages for bad credit customers

How to improve your chance of acceptance

How can Hippo help me get accepted for bad credit vehicle finance?

You might be trying to finance a car loan with no credit history. Or perhaps you have bad credit but a good income and need to buy a car, but your poor credit history is holding you back – or so you think.

With over 50 years’ experience helping people get the car they want, Hippo knows that finding a vehicle when you have bad credit is possible if you use the right company. No jargon. No finance riddles. Straightforward car finance.

The Hippo team has experience helping people from diverse credit backgrounds get the car they want. Plus, you’ll get access to a vast range of specialist bad credit lenders, which will increase your chance of acceptance. Hit the apply button and use our FREE soft credit check that has no impact on your credit score.

3 benefits of using Hippo for bad credit car finance

Why our customers trust us with their new car

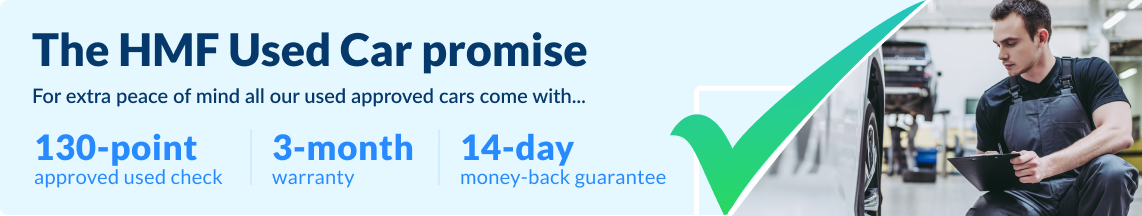

If you’ve got bad credit or have financial difficulties, the last thing you want is to get stuck with a car you don’t like or one that needs expensive repairs. All our car finance packages come with these features as standard, so you can relax knowing you’re getting a reliable vehicle.

- All our cars come with a free 130-point check, and no vehicle leaves our showroom without passing it. If the car comes directly from the manufacturer, it will be subject to their assessments.

- We offer a 14-day money-back guarantee, so if you aren’t happy with your vehicle you can get a refund.

- As well as your money-back guarantee, you can rest easy knowing you’ll receive an extra three months warranty from Hippo.

Helpful and useful guides

Everything you need to know about getting a car when you have bad credit.

What is a credit score and how does it affect a car finance application?

What is a credit score & how does it affect a car finance application?

How do I check my credit score before applying for a car loan?

How do I check my credit score before applying for a car loan?

What credit checks are done for car finance and will I get accepted?

What credit checks are done for car finance and will I get accepted?